By Rituraj Baruah,

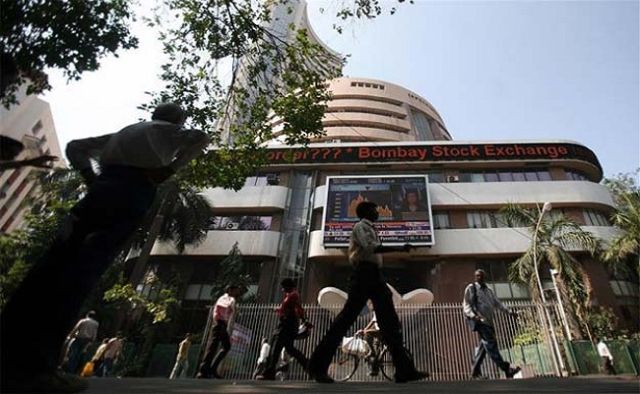

Mumbai : Growth in the manufacturing sector and a hike in the minimum support prices of Kharif crops supported investor sentiments and lifted the key equity indices in the week ended Friday.

However, escalation in the trade war tensions between the US and China limited the gains on the domestic indices.

Providing a major support to the market, the Nikkei India Manufacturing Purchasing Managers’ Index (PMI), rose to 53.1 in June from 51.2 in May, registering the fastest improvement since December 2017. The data was released on Monday.

Index-wise, the wider Nifty50 of the National Stock Exchange closed the week’s trade at 10,772.65 points — up 58.35 points or 0.54 per cent — from its previous close.

The barometer 30-scrip Sensex of the BSE rose by 234.38 points or 0.66 per cent to close at 35,657.86 points on a weekly basis.

The market breadth was negative in three out of the five trading sessions of the week, said Deepak Jasani, Head of Retail Research at HDFC Securities.

Prateek Jain, Director, Hem Securities said: “Benchmark indices logged modest gains last week as India’s manufacturing conditions improved in June 2018 at the strongest pace since December 2017 boosted sentiment.”

According to Equity99’s Senior Research Analyst, Rahul Sharma: “Auto and consumer stocks were in demand throughout the week after the Union Cabinet approved a hike in minimum support prices for Kharif crops by 1.5 times of the input cost for the 2018-19 season. This is likely to have a positive effect on the overall economy.”

Jain, however added, gains were capped by the escalating trade war between the US and China.

Further, he said, the Indian rupee weakened during the week to touch a fresh closing low of 68.95 on Thursday, amid fears over a slowdown in the economy which affected the trading sentiments.

On a weekly basis, rupee closed at 68.88, weaker by 41 paise from its previous week’s close of 68.47 per greenback.

In terms of investments, provisional figures from the stock exchanges showed that foreign institutional investors sold scrip worth Rs 2,455.44 crore, while the domestic institutional investors purchased stocks worth Rs 2,073.70 crore during the July 3-6 period.

Figures from the National Securities Depository (NSDL) revealed that foreign portfolio investors (FPIs) divested Rs 2,737.04 crore, or $398.62 million from the equities segment on stock exchanges during the week ended on July 6.

Sector-wise, auto and FMCG were the major gainers and those ending in the negative include metals, infrastructure and realty, Jasani told IANS.

The top weekly Sensex gainers were Bajaj Auto (up 7.55 per cent at Rs 3,023.35); Maruti Suzuki (up 5.48 per cent at Rs 9,304.80); Hero MotoCorp (up 4.74 per cent at Rs 3,636.70); Asian Paints (up 4.64 per cent at Rs 1322.80); and Yes Bank (up 3.77 per cent at Rs 352.40 per share).

The major losers were Vedanta (down 6.89 per cent at Rs 219.50); NTPC (down 5.77 per cent at Rs 150.25); Bharti Airtel (down 5.03 per cent at Rs 361.85); Power Grid (down 2.89 per cent at Rs 181.25); and Tata Steel (down 2.41 per cent at Rs 554.15 per share).

(Rituraj Baruah can be contacted at rituraj.b@ians.in)

—IANS